Consistency is not about instant success.

It's about lasting success.

Benefit from our unique combination of deep global resources, the collective expertise of over 400 global investment professionals and a nearly 30-year track record of consistently delivering strong client returns when you choose to invest with M&G Investments Southern Africa.

We are able to deliver better client outcomes, offering a range of specialist capabilities and bespoke solutions designed with our clients’ needs in mind, while incorporating ESG considerations and sustainability in all that we do.

Every M&G Investments employee is a shareholder in our business and each one invests their retirement savings alongside our clients, in the same M&G unit trust funds. On top of this, a large part of our investment professionals’ remuneration depends directly on investment performance.

Total assets under management

N$316 Billion

Unit trust MANCO

N$151 Billion

Segregated and Life Pooled

N$165 Billion

AUM Reflected as at 30 June 2023

Founded in

Cape Town, 1994; Windhoek 1996

Offices

Cape Town (Head Office), Windhoek, Johannesburg, Durban & Gqeberha

Number of staff

190+

BBBEE

Level 1

Ownership

M&G Investments Southern Africa: 75%; Prudential Portfolio Managers Staff Trust: 10%; Horizon Investments (Pty) Ltd: 15%

License

MandG Investments (Namibia) (Pty) Ltd is an approved Investment Manager in terms of the Stock exchange Control Act.

Our investment philosophy and process

We have consistently used our rigorous, valuation-based approach in managing our funds since the start of the business in 1994.

We focus on fundamental company valuations (“bottom-up”) instead of broad investment themes (“top-down”), and only buy an asset if its price is below its long-term fair value. We are also risk-conscious in our portfolio construction and asset choices, aiming to both grow and protect our clients’ savings over time.

- We employ a rigorous valuation-based investment process

- We are risk-conscious and active asset managers

- We make decisions based on known facts, and we don’t try to forecast the future

- We focus on the long term and try to ignore short-term “noise”

- We have a consultative, team-based approach

- As shareholders we engage actively to address ESG risks.

Why invest with us?

We have a nearly 30-year track record of consistently delivering strong returns for our clients through different cycles in the South African and Namibian financial markets.

Our diverse and experienced local investment team is focused solely on managing our clients’ savings, together with the expertise of over 400 global investment professionals.

Our deep resources allow us to invest in the latest technology to expand the breadth and diversity of the investment universe across all asset classes and deliver better client outcomes.

Our scale gives us a meaningful influence on ESG related investments, whether in decarbonisation, a Just Transition, or helping make the local financial services industry more accessible for all.

The diversity of our staff across race, gender, age, training and experience contributes to a rich, team-based business culture where all ideas are welcomed, helping add value to client results and interactions.

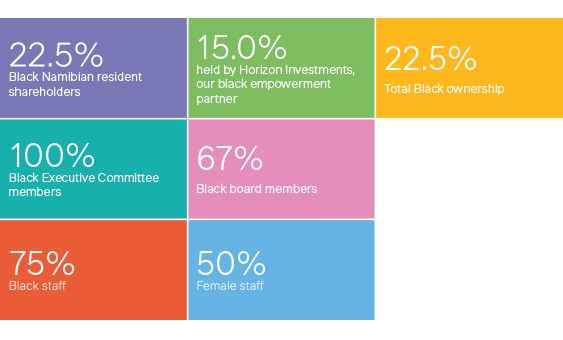

Black economic empowerment and transformation

In the absence of Black Economic Empowerment regulation in Namibia, we took the initiative and active steps towards progressing transformation within our business.

Transformation for us is not about a scorecard or our internal successes; it is about transforming ourselves and the financial services industry and empowering the communities we live in. Equally, greater diversity and inclusivity in our investment ideas, teams, risk management, operations and client services will enable us to better understand the needs of our clients and deliver better client outcomes.

Numerous measurable actions exist across the business to further the cause of transformation within a formal governance framework.

We develop multi-year Employment Equity Plans, the implementation of which is monitored and evaluated by our Employment Equity Forum. This approach truly supports our transformation journey, rather than mechanistically addressing scorecard objectives.

Our interests are aligned with our clients'

Every M&G Investments employee is a shareholder in our business and each one invests their retirement savings alongside our clients, in the same M&G Investments unit trust funds. On top of this, a large part of our investment professionals’ remuneration depends directly on investment performance.

Our vision

Our vision is to help our clients achieve their financial goals by successfully managing their investments using our long-established prudent valuation-based approach. We strive to outperform our clients’ investment objectives steadily over time, because consistency is the key to successful investing.

We know that our delivery on this commitment will lead to long-term success for our clients, our staff, our shareholders and our communities.

South Africa

South Africa Namibia

Namibia